The Power of Growth: Roth IRA

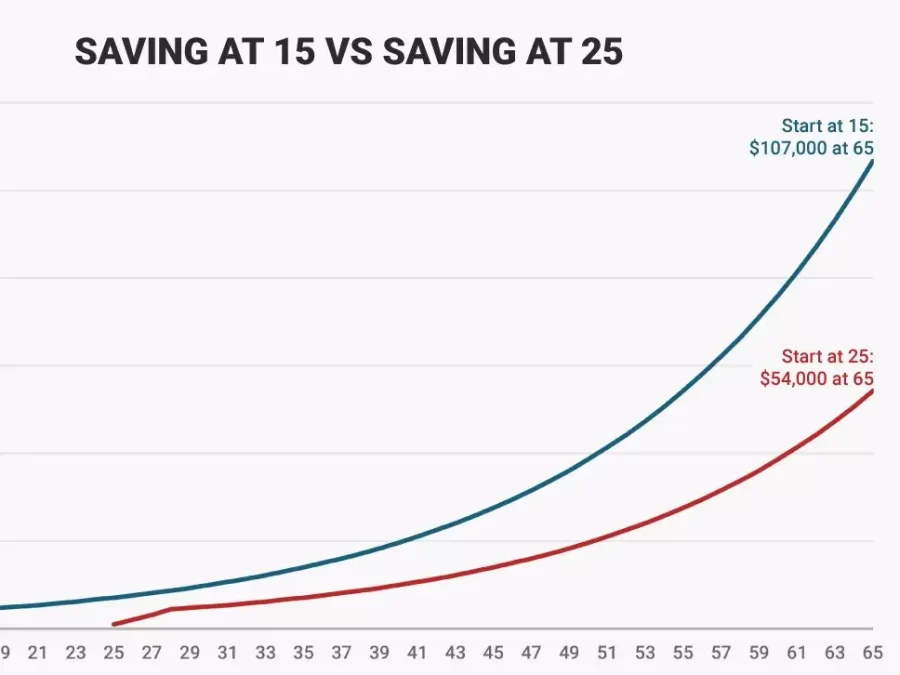

The graph shows how much more money a contributor can earn by beginning to contribute to a Roth IRA at age 15 versus age 25.

March 6, 2023

A Roth IRA is an individual retirement account you can contribute to after tax dollars. Your contributions and earnings grow tax free. The average annual return is estimated to be 7% – 10%. The Roth IRA is directed toward individuals who earn less annually; $153,000 is the most you can make in 2023 to open a Roth IRA. The maximum amount you can contribute in a year is $6,500 (divided up to $542 each month). The only exception is if you’re 50 years or older, then you can contribute $7,500 annually ($625 each month).

To withdraw from the account penalty free, you must own the account for five years and be at least 59 years old. Once an investor retires, withdrawals from the account are tax-free. There’s no age limit to open a Roth IRA. If you are too young to own your own account your parents can start it for you, and once you are of age, it can be switched to your account. The goal of a Roth IRA is to save up and invest for retirement after employment. If you have a 401k, (the most commonly known retirement plan) it’s still a good idea to have a Roth IRA because it offers more investment options and greater tax benefits.

Dave Ramsey is a radio show host, author, businessman, and American personal financer. He gives advice on how to save and be responsible with banking and financing. Ramsey strongly believes most people should invest in a Roth IRA. On his blog, he discusses the benefits of the Roth IRA. In part of the blog, he explains, “If your account grows by hundreds of thousands of dollars over time, you won’t owe taxes when you withdraw that money in retirement! That’s a huge perk, especially for folks who expect to be in a higher tax bracket when they retire.”

The Roth IRA was named after William Roth, a U.S. senator from Delaware who sponsored retirement-related legislation including the Roth IRA, which became a savings option in 1998. The Roth IRA offers hidden tax benefits. These accounts give you tax-free income, which can lower your tax bill in the future. Although these retirement accounts have no required minimum distributions, if you withdraw from an account before you are 59, you will have to pay a 10% early withdrawal penalty and taxes will be taken out.

The difference between a Roth IRA and a traditional IRA is important. Because the owner of a traditional IRA uses pre-tax income to invest, they benefit in the short run but end up paying more taxes in the long run due to paying at a higher future rate as a retiree who begins withdrawing funds from the account. In contrast, a Roth IRA owner contributes post-tax income to invest, so when the age and time requirements are met this investor can withdraw all their money tax free. It’s hard to see it, but paying taxes before you withdraw your account will save you more in the long run.